According to the latest data release from the General Insurance Association of Japan, insurance claims paid for the January 1st M7.5 earthquake that hit near the Noto Peninsula in Ishikawa prefecture have risen by approximately 22% just a few weeks, to roughly US $492 million.

When we last covered the claims paid data from the GIAJ back on March 22nd, which included claims data to March 8th, the figure reported was running at almost US $415 million (currency conversion as of March 8th).

When we last covered the claims paid data from the GIAJ back on March 22nd, which included claims data to March 8th, the figure reported was running at almost US $415 million (currency conversion as of March 8th).

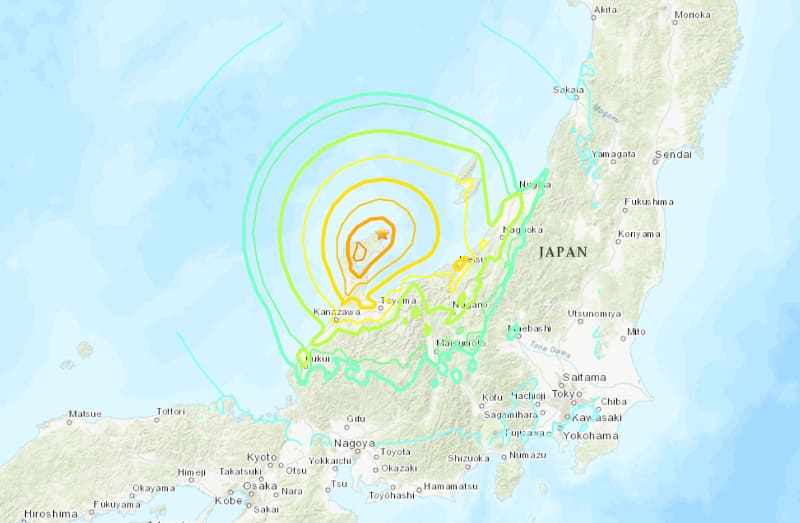

The so-called Noto Peninsula Earthquake struck on January 1st and caused severe impacts to some towns across the four Japanese prefectures of Ishikawa, Niigata, Toyama, and Fukui.

Significant property damage was experienced and as the insurance and reinsurance market loss estimates began to emerge, it was clear the event was a relatively significant one for the domestic insurance industry, with the potential for some minor global reinsurance effects as well.

The General Insurance Association of Japan (GIAJ) has now explained that the total claims paid has reached over JPY 74.44 billion as of March 31st 2024.

At that date, this figure converts to just over US $492 million. Or, at today’s date, it’s nearer $481 million because of currency fluctuations (note, it would have been over US $525 million at the date the quake actually struck).

The previous figure in JPY was just under 61 billion, so the updated claims paid figure of just over JPY 74.4 billion is now almost 22% higher.

The GIAJ now says that as of March 31st there had been 128,263 accepted insurance claims for damage to houses and household goods, while 115,171 investigations have been made into claims filed so far.

Some 81,544 claims payments have been made, resulting in the more than JPY 74.44 billion in claims payments made to March 31st.

The 2024 Noto Peninsula earthquake loss remains the seventh largest insured loss from a Japanese earthquake event so far.

The figures from the GIAJ cover claims date reported by member companies of the General Insurance Association of Japan and the Foreign Non-Life Insurance Association of Japan.

As a result, they do not include all losses to global insurance and reinsurance entities operating in Japan, as some may not be members.

Recall that, the first industry loss estimate to be released for this Japanese earthquake was from modelling firm Karen Clark & Company (KCC), which put the insured losses from the quake at an estimated $6.4 billion.

The next to issue an insurance market loss estimate for the Japanese earthquake was CoreLogic, which said it is likely to be below $5 billion.

View all of our Artemis Live video interviews and subscribe to our podcast.

View all of our Artemis Live video interviews and subscribe to our podcast.

All of our Artemis Live insurance-linked securities (ILS), catastrophe bonds and reinsurance video content and video interviews can be accessed online.

Our Artemis Live podcast can be subscribed to using the typical podcast services providers, including Apple, Google, Spotify and more.